- New Vaping Products Duty structure announced in the Autumn Budget

- Proposed changes to vaping legislation so far

- Vaping Products Duty raises concerns for vapers

- The Times reports vape tax plans ahead of Spring Budget

- What vape taxes are seen in other countries?

- Why would the Government consider a tax on vapes?

- Timeline: changes to vape regulations and tax

- What would a vape tax means for UK vapers?

- Has a vape tax been considered before?

The 2025 budget, held on 26th November 2025, finalised that the Government plans to introduce a Vaping Products Duty due to be brought into force in October 2026. This duty will be applied to all vaping products containing e-liquid, including bottles of vape juice and prefilled pods.

New Vaping Products Duty structure announced in the Autumn Budget

The 2024 Autumn Budget, announced on 30th October 2024, has revealed that the Labour government have scrapped the previously planned tiered structure and will instead by introducing a flat rate of excise at £2.20 per 10ml of e-liquid. Registrations and approvals for the new duty will start from 1 April 2026 for the tax to come into force in October 2026.

As part of the Spring Budget 2024 earlier this year, the previous Tory government confirmed that they intended to introduce a Vaping Products Duty, to be imposed on e-liquids. This tax duty was not included as part of the Tobacco and Vapes Bill, and so was not been affected in the same way by the call for a general election. However, the new government have made significant changes to the originally proposed structure.

Previously, the rates from the Spring Budget announcement were based on a tiered structure that increased depending on nicotine strength. This included £1.00 per 10ml for nicotine-free e-liquids, £2.00 per 10ml for e-liquid which contain 0.1-10.9 mg/ml of nicotine, and £3 per 10ml on liquids which contain 11 mg/ml or more of nicotine. The duty would be applied at their point of manufacture for e-liquids produced in the UK, and at the point of importation for those produced outside of the UK.

In addition to the vape duty, they planned to also introduce a one-off increase in tobacco duties, aiming to ensure that tobacco prices rise in line with those of vaping products, ensuring that vaping is still a cheaper alternative to smoking. Alongside this they announced the opening of a consultation led by HM Treasury and HM Revenue and Customs which closed on 29th May 2024.

The Labour Government confirmed in the Autumn Budget that the feedback from this consultation informed their proposed changes to the structure, completely removing the tiered rates based on nicotine strength and replacing them with a flat rate of £2.20 per 10ml applied to all e-liquids regardless of nicotine content. The Vaping Products Duty was confirmed as finalised in the 2025 Budget.

While we are glad to see the tiered structure which penalised those who used higher nicotine strengths has now been scrapped, many in the industry are extremely disappointed by the level of taxation that is now being proposed. The cost of £2.20 (plus VAT) per 10ml represents a significant price increase to a product that millions of users rely on to help them remain smoke-free.

While the Government are lauding the duty as a way to raise funds for public services like the NHS, they are not acknowledging the millions of pounds that vaping has already saved the NHS in treatment for smoking related illness. By making the switch from smoking to vaping, an alternative that is recognised to not only be 95% less harmful than smoking, but also to be extremely effective and the most popular option in the UK, around 3 million adults have been able to successfully quit smoking and avoid further damaging their health, lessening the significant burden that smoking lays on the NHS.

Not only does this announcement have the potential to deter smokers from considering vaping as an alternative in the future, but it also stands to raise the cost for current vapers, especially those who are on a lower income and rely on budget e-liquid options. Vape liquids currently start at around 99p for a 10ml bottle, which would rise to £3.83 for an incredible increase of 267%. In a population already facing a cost of living crisis, this increase could prove to be a substantial barrier to many.

A technical consultation was launched to coincide with this announcement, seeking views on ways to limit the illicit production of e-liquids by limiting the supply of nicotine. The consultation ran until 11th December 2024.

Proposed changes to vaping legislation so far

On January 28 2024, Rishi Sunak announced a proposed ban on disposable vapes as well as powers to restrict vape flavours, introduce plain packaging and change the way vapes are displayed in shops, with the intention to reduce the appeal and access of vapes to underage people and combat environmental concerns.

Sunak also announced plans for a new law that will make it illegal to sell tobacco products to anyone born on or after 1 January 2009. The call for a general election has meant that the Tobacco and Vapes Bill which would have facilitated the restrictions on vaping products and the generational tobacco ban were abandoned, and will be reintroduced by the Labour government but may included changes. The disposable vapes ban came into effect on 1 June 2025.

Vaping Products Duty raises concerns for vapers

Concerns are already being raised that this duty could undermine the fact that the Government endorse vaping as a stop smoking tool, and disproportionally affect those of a lower income.

CEO and Founder of Evapo, Andrej Kuttruf, shared his concerns:

"The party set to benefit most from the new Spring Budget are the criminals responsible for the illicit vaping market in the UK, while legitimate retailers who are following the rules will feel the consequences. This tax increase will only serve to fuel the fire of this already flourishing illicit market, if significant changes are not made to increase border controls and solve the question of the border checks between Northern Ireland, Great Britain, and the EU.

"I fear that the Government's decision to impose a tax on vaping liquid will stall, if not reverse, the declining smoking rates seen in the UK by making it harder for those attempting to make a stop smoking attempt."

IBVTA chair Marcus Saxton, also commented on this saying:

“The government has already proposed regulation that will ban single use products, which despite helping many adult smokers access vaping, have via irresponsible retailers been disproportionately accessible to children.

"It would seem a little questionable then to increase the cost of vaping, especially for the higher strength liquids which many smokers need to make the switch, when you’ve still got around six million adult smokers for who you’re trying to give every opportunity to make the transition to less harmful products."

Research suggests that increasing the price of vaping products can actually lead to vapers turning back to smoking, with a study from Huang, Tauras & Chaloupka finding that the use of ENDS (Electronic nicotine-delivery systems) can be very responsive to price increase, with only small increases having a significant impact on their use, especially among younger adults. This is enforced by a further study on young adult responses to taxes on vaping products, which found that 'higher ENDS tax rates are associated with decreased ENDS use, but increased cigarette smoking among 18- to 25-year-olds'.

The World Vapers' Alliance makes the argument that alternative nicotine products should be taxed in accordance with their risk relative to smoking, stating that 'since vaping is 95% less harmful for the user and does not have negative effects to those around (them), it is only proportional that taxes are 95% lower too.' This would help to ensure that the price difference between smoking and vaping remains significant enough to act as another incentive to make the switch.

The Times reports vape tax plans ahead of Spring Budget

The Times reported at the end of February that Jeremy Hunt would be announcing a "vaping products levy" in the upcoming Spring Budget, with the aim of making vaping products less affordable to minors. This will be paid on imports and by the manufacturers, and will be levied based on the e-liquid in the vapes, with higher nicotine products having a higher level of tax.

Reports suggested this new vape tax would be modelled on 15 similar schemes currently in action across Europe, for example, Germany impose a €1.60 tax on every 10ml of e-liquid, and Italy €1.30.

As with all proposed vaping regulations currently being discussed, this levy aims to make vaping products less appealing and accessible to those under 18, while ensuring they remain an accessible and viable stop smoking tool for adult smokers and current vapers. Ministers have acknowledged “the need to balance a price increase that acts as a deterrent with ensuring that vaping remains a more affordable option than smoking, to encourage adult smokers to switch”.

In line with this, the budget has also announced a one-off increase in tobacco duty, ensuring that vaping remains a substantially cheaper alternative to smoking. It is expected that the introduction of a vape tax along with the increase in tobacco duty will raise a combined amount of over £500 million annually by 2028/29.

Responding to this proposed levy, Evapo CEO, Andrej Kuttruf, said:

“Evapo is concerned to see reports that the Chancellor intends to raise taxes on vaping liquids at next week’s Budget. A tax increase would send the wrong message to smokers. Vaping is at least 95% less harmful than smoking, according to the Office for Health Improvement & Disparities, and twice as effective in helping smokers quit compared to any other method. Taxing both in the same way risks muddying that message.

“A tax increase would pour petrol on the flames of the already flourishing illicit market and should only come with a big step up in efforts to tackle the illicit market through increased border controls to stop illicit and untaxed products coming in.

“Over 2.5 million former smokers have successfully quit by vaping, saving the NHS billions in the process, but most started out vaping the highest strength nicotine before reducing and finally quitting. The Government’s proposal to tax vaping liquid by nicotine strength would therefore do the most harm to smokers looking to quit and could lead many smokers to continue smoking, a much worse public health outcome.

"Raising taxes on vaping liquids could also make it harder to supply the smoking cessation market, injecting uncertainty into local authorities’ budgets for smoking cessation programs like Swap to Stop.

“Evapo believes the best way to support the public finances, protect children, help smokers quit, and stop the criminals that sell vapes illegally is by introducing a common sense, evidence-based licensing regime, as was published in Parliament last week. Allowing retailers to pay an annual fee will keep standards high, enable enforcement, help smokers quit, and bring in more tax revenue than the government’s current approach of bans and tax rises."

Responding to the news, the Independent British Vape Trade Association (IBVTA) have pointed out that calls for an excise tax were predominantly aimed at single-use vapes, as a way to make them less accessible to young people and address the environmental concerns about the waste they produce. Instead, the tax is intended to apply to e-liquids, meaning it will affect those using refillable and rechargeable vapes as well. Not only are these products not responsible for the recent surge in youth vaping, but they are also the products that those who have been using single-use vapes will need to transition now that the proposed disposable vapes ban has gone through.

They express fears that this tax on e-liquid will disproportionally affect those products and businesses that are already compliant, and actually have a bigger impact on reusable vaping products than on the single-use products, IBVTA Chair Marcus Saxton explains:

“Applying an excise on liquid refills used with refillable and rechargeable devices would do very little to elevate the prices of products most liable to youth uptake, and conversely disincentivises moving consumers to more sustainable products."

What vape taxes are seen in other countries?

The vape taxes in other countries have helped inform those proposed in the UK, although it should be noted that the £2.20 per 10ml flat rate would be the highest rates in Europe.

Belgium levies a tax of €0.15 per millilitre on all e-liquid.

Germany charges a €0.20 per millilitre tax on all e-liquid, with plans to raise this to €0.26 in 2025.

Greece has a €0.10 per millilitre tax on all e-liquid.

Italy taxes €0.13 per millilitre for e-liquids containing nicotine and €0.08 for those without.

The USA also taxes e-liquids but the rate varies by state, with some charging a flat rate per millilitre and others taxing a percentage of the overall cost.

In December 2023, Ireland’s Minister for Finance Michael McGrath announced that they were holding off on introducing a new tax on vaping amid fears it might put off smokers who were using vaping devices to help break the habit. Officials from the Department of Finance stated the need for a delicate balance between supporting smokers in giving up cigarettes and protecting young people from vaping.

Why would the Government consider a tax on vapes?

The Government’s main aim in introducing a tax on vapes is to increase the price of vaping products like e-liquids and make them less accessible for children, and less appealing to non-smokers.

The UK Government charges a duty rate on cigarettes, cigars and other tobacco products. At the moment, vapes are currently subject to VAT (value added tax) but under new plans, they may also be eligible for a duty rate in the same way that cigarettes are. Currently, there is an estimated excise duty of at least a £8.46 on a packet of 20 cigarettes.

Right now, vaping is significantly cheaper than smoking. This makes it a viable option for those who are hoping to quit smoking cigarettes, and vaping has been recognised by the Government as being at least 95% less harmful than smoking. The NHS reports that smokers are twice as likely to quit using a nicotine vape compared to other nicotine replacement therapies. There are concerns that a new tax for vapes might discourage people from using them as a tool to quit smoking.

In the consultation outcome, Creating a smokefree generation, the Government states that it believes there is a strong case to take action to reduce the affordability of vapes. It cites a new duty as one of the options it is considering to achieve this.

In general, taxes are also used as a way of raising money or offsetting the costs of certain activities. For example, the consultation outcome also stated that smoking costs the economy and wider society in England £17 billion a year and the tax raised in excise duty revenue is only approximately £10.2 billion. The excise duty on cigarettes therefore goes in some way towards recouping the cost of smoking to the country.

The Times article reveals that the estimated funds which the vape tax combined with an increased tobacco duty will raise could be upwards of £500 million per year. As part of their ‘Stopping the start’ plans, the Government has announced additional funding of £30 million per year to bolster enforcement agencies like Trading Standards and Border Force, helping them better enforce the law, combat underage sales, and tackle illicit vape trade. They will also be introducing new powers to local authorities to be able to issue more strict on-the-spot fines to those retailers who are caught selling both tobacco products and vaping products to underage people. It is possible that the funds raise by a new duty on vaping products could assist in providing this funding, in addition to reducing the affordability of vaping products to underage people.

Timeline: changes to vape regulations and tax

August 2018 - A tax on vape products was raised for the first time as part of the 2018 Autumn Budget.

March 2023 – Following calls for a tax on disposable vapes in the Spring Budget 2023, the Chancellor confirmed there were no plans for one at the time.

11 April 2023 – The Government issue an eight week ‘Youth vaping: call for evidence’ to identify ways to reduce youth access to vape products including understanding pricing. 441 responses are received from individual citizens and organisations.

12 October 2023 – The Government opens consultation ‘Creating a smokefree generation and tackling youth vaping’ and invites responses from the general public.

7 November 2023 - The King announces plans for a 'Tobacco & Vapes Bill' that would give the Government new powers to add an excise tax on vapes in his annual speech.

6 December 2023 – The Government’s consultation is closed, and the responses are collated.

28 January 2024 – Prime Minister Rishi Sunak announced Government plans to ban disposable vapes and introduce other measures to tackle youth vaping.

27 February 2024 - The Times article reveals a vape tax is expected in the Spring Budget, and expands on what such a levy may look like.

6 March 2024 – The Spring Budget has been confirmed and the Chancellor Jeremy Hunt has commissioned the Office for Budget Responsibility to prepare an economic and fiscal forecast to be presented to Parliament alongside it. A Vaping Products Duty is announced along with the opening of a consultation led by HM Treasury and HMRC.

22 May 2024 - Rishi Sunak called for a general election to be held.

29 May 2024 - The HM Treasury and HMRC led consultation closed.

30 May 2024 - Parliament dissolved.

4 July 2024 - A general election was held to determine the new Government.

9 October 2024 - The launch of a two month inquiry into the role of vaping by the APPG.

30 October 2024 - The Autumn Budget revealed a new flat rate excise for vaping products as opposed to the previous tiered structure. This also launched a technical consultation on additional compliance measures.

11 December 2024 - the second consultation ends.

26 November 2025 - the VPD is confirmed in the 2025 Budget.

1st October 2026 - The proposed date for the introduction of the Vaping Products Duty, along with an increase in tobacco duties.

1st April 2027 - The end of the six-month grace period for companies to sell through stock manufactured or imported before the duty.

What would a vape tax means for UK vapers?

There is no question that a vape tax would mean that vapers in the UK would end up seeing a rise in prices. The Independent British Vape Trade Association (IBVTA), which is the leading independent trade association for the UK vaping industry, issued a statement about the proposed ban and changes to regulations.

Marcus Saxton, IBVTA Chair, stated that the vape industry stands ready to work with Government to implement a proportionate regulatory regime. However, bans and higher taxes could make it harder for smokers to quit and even push those who have already quit back towards cigarettes. It is hoped that the reformed Government will be open to working with vapers and the wider vaping industry to find a level of taxation which balances the need to tackle youth vaping with the need to ensure that vaping remains an affordable and accessible option for adult smokers and vapers.

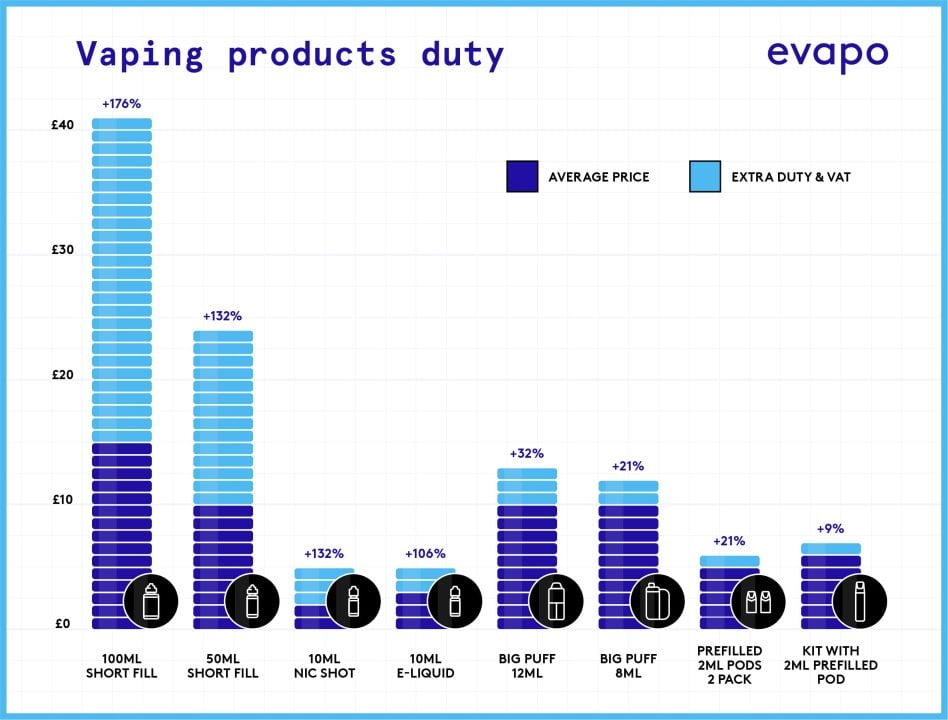

How will vape prices change?

If you're thinking ahead and wondering how the price of the vape products you use may change, we've put together a table and infographic with our calculations for approximate prices and increases on vape products that we expect to see.

| Product type | Current average price | New price inc. VAT | Percentage of price increase |

| 100ml short fill | £15.00 | £41.40 | 176% |

| 50ml short fill | £10.00 | £23.20 | 132% |

| 10ml nic shot | £2.00 | £4.64 | 132% |

| 10ml e-liquid | £2.50 | £5.14 | 106% |

| Big puff 12ml | £10.00 | £13.17 | 32% |

| Big puff 8ml | £10.00 | £12.11 | 21% |

| Prefilled 2ml pods 2 pack | £5.00 | £6.06 | 21% |

| Kit with 2ml prefilled pod | £6.00 | £6.53 | 9% |

Vaping will remain cheaper than smoking

It’s worth remembering, though, that even though the new excise duty is being introduced for e-liquids, vaping will still be significantly cheaper than smoking. Especially when using refillable pods kits and reusable devices.

The Autumn Budget has confirmed that the tobacco duty will be increased by £2.20 per 100 cigarettes or 50g of tobacco in line with the introduction of the Vaping Products Duty.

Packaging changes

The Vaping Products Duty will also lead to a small change in the packaging of vaping products, as a duty paid stamp will need to be applied to any product that is applicable to the duty. This will come in the form of a small sticker stamp used to seal the product, which will need to be torn to open the product. The stamp will incorporate digital elements which will allow for tracing and authenticity, as well as including a hologram and other features to prevent counterfeiting.

It has been confirmed that companies will be given a six-month grace period from 1st October 2026 to 1st April 2027, for products manufactured or imported before 1st October to be sold. This means that until 1st April 2027 companies will still be able to sell through their stock of products that were manufactured or imported before the ban and therefore do not have the stamp seal.

Has a vape tax been considered before?

This is not the first time that a vape tax has been proposed, as a duty on vape products has been raised both ahead of two previous budgets.

In March of 2023, there were calls for a levy to be applied to disposable vapes, but the Chancellor quickly made it clear that this was not something that was being considered at the time.

But the first time a tax on vaping products was proposed was back in 2018, when the Treasury announced a proposed 'Sin-Tax' that would be applied to all vaping products in the UK, as a way to help fund the additional £20 Billion that had been pledged to the NHS.

This proposed tax would have been introduced as part of the Autumn Budget for 2018, and estimates expected it could raise an additional £40 million in funds. However, many were quick to point out that vaping had assisted many of the 2.9 million vapers in the UK at the time in quitting smoking, and that punitive action was at odds with the benefits that vaping could hold as a stop smoking aid.

Many organisations, such as the UKVIA, pointed out that the increasing popularity of vape kits as a way to aid in a stop smoking attempt had actually helped to relieve some of the pressure on the NHS in the long term, so why would we add additional taxes to these products that could discourage people from using them and prohibit the growth of vaping as an alternative to smoking? That growth has clearly been demonstrated, as there are now an estimated 6 million vapers in the UK and smoking rates are at the lowest since records began.

Back in 2018 when this 'Sin-Tax' was being suggested, Andrej Kuttruf, CEO and Founder of Evapo, shared:

"One in every 4 patients visits the hospital due to smoking related diseases. The NHS itself estimates that every smoker who switches to vaping saves the NHS £85k."

We shared the view that increasing VAT on tobacco products would support the NHS both in the short term and long term, by helping to raise the additional funding that has been pledged to the NHS, but also by helping relieve the long term drain on the health service by encouraging people to make the switch to a less harmful and less expensive alternative like e-cigarettes.

Fortunately, plans for the tax were scrapped and the Government has since recognised the important role that vaping can play as a smoking cessation tool, even coming to offer smokers a free starter kit as part of their 'swap to stop' scheme. This recognition has also changed the discussion around a vaping tax that we are seeing today, with the importance of balancing the need to make vaping products inaccessible to minors and the need to ensure they are accessible to adult users at the forefront as a main consideration.

The supply of a single-use disposable vape is now banned in the UK. Shop our wide range of disposable-style reusable vapes or vape kit alternatives to disposables.

Sources

gov.uk 26/11/2025

gov.uk 30/10/2024

gov.uk 30/10/2024

gov.uk 30/10/2024

Gov.uk 28/01/2024

Gov.uk 12/10/2023

gov.uk 06/03/2024

gov.uk 06/03/2024

conveniencestore.co.uk 06/03/2024

ibvta.org.uk 06/03/2024

thetimes.co.uk 27/02/2024

gov.uk 29/09/2022

ibvta.org 27/02/2024

Mirror.co.uk 30/12/2023

taxfoundation.org 29/08/2023

Breakingnews.ie 19/12/2023

Gov.uk 22/11/2023

Gov.uk 29/09/2022

Gov.uk 12/02/2024

Gov.uk 11/04/2023

Gov.uk 27/12/2023

Ibvta.org.uk 26/01/2024

gov.uk 07/11/2024

express.co.uk 02/08/2018

ukvia.co.uk 2018

pubmed.gov 07/2014

onlinelibrary.wiley.com 19/07/2022

responsiblevapingappg.org 09/10/2024